WAR RUSSIA VS UKRAINE // Commodity Prices Jump The Most in 60 Years While Stocks Get Crushed As War Escalates

Commodity Prices Jump The Most in 60 Years While Stocks Get Crushed As War Escalates

Chapter guide:

- Product Prices Spike To Historical Levels

- The Russian Bid Sent BTC Jumping 15% Early Week

- BTC Retreats While Gold Edges Higher

- Long haul Holders Not Selling BTC Yet

- LUNA's Algometric Stablecoin Gains Popularity

The business sectors began the week on a wild note, with resonations felt across the whole monetary business sectors across the world, as worldwide stocks kept on failing on the rear of the aftermath between the Western nations and Russia in light of Russia's intrusion of Ukraine.

As more extreme approvals were slapped on Russian saves money with the expulsion from SWIFT and weighty assents on Russia organizations and the well off, the Russian Ruble plunged to its authentic low of 120 against the USD. The Russian national bank, unfit to mediate in the FX markets because of its unfamiliar stores being seized, needed to raise its financing cost to 20% from 9.5%, and advised trade centered organizations to offer unfamiliar money to stem the Ruble's breakdown.

To forestall gore in value esteems, the Moscow Stock Exchange was shut all week long, while European offers were intensely beat, with selling escalated on Friday after bits of hearsay that Russian soldiers figured out how to hold onto control of Europe's biggest power plant in Ukraine. The Euro-50 Index fell a further 11% on its fourth seven day stretch of decline, with around 5% of it contributed by Friday alone. With European stocks disintegrating, the EUR/USD dropped like a stone, effectively breaking the $1.10 level on Friday, and therefore earning back the original investment the $1.09 level in Asia exchanging today.

It was no greater over in the US, with the three significant US stock lists losing ground for the fourth week also on unstable exchanging. The Dow lost 1.5% last week, the S&P 500 dropped 1.3%, while tech stocks were hit the hardest - the Nasdaq lost 2.8%.

The improvements in Ukraine eclipsed a surprisingly good February occupations report delivered on Friday. The US economy added 678,000 positions last month, over the 440,000 expected by market analysts, while the joblessness rate ticked down to 3.8%. Notwithstanding, the more grounded numbers never really assisted the US with loading market.

This is the last positions report before the FED gathering next Wednesday, where the national bank is relied upon to start climbing financing costs. Taken care of Chair Powell nonetheless, started to tone down on hawkish comments and said last week that he is reallyinclining in the direction of supporting a solitary 25-premise point climb in March, recognizing exceptionally dubious impacts of the Russian conflict on Ukraine.

The security market appeared to agree that US financing costs wouldn't spike as much true to form, with the 10-year Treasury yield slipping from more than 1.9% on Monday to 1.73% before the finish of Friday.

A few specialists in any case, don't figure the FED would decrease the speed of rate climbs, refering to significantly higher expansion ahead because of production network interruptions in view of the conflict. The higher pace of expansion is now being felt across the whole ware complex, with energy and ware costs taking off to levels not found somewhat recently because of the significance of Russia as a net product country in essential items.

Commodity Prices Spike To Historical Levels

The one product presently at the center of attention is Oil. As Russia represents around 12% of the world's oil send out, Oil costs took off to 11-year highs, with Brent Crude acquiring around 25% early week to hit a high of $119 pb and WTI Crude Oil acquiring 27% to a high of $115. The standpoint at oil costs stays slanted to the potential gain as long as the conflict circumstance isn't settled. In last week's standard OPEC+ month to month meeting, the impacts of the current conflict were not referenced. The oil cartel chose to hold yield consistent and stay with its Russia-upheld oil creation bargain. Without a doubt, after the Western nations are uncovered to consider prohibiting Russian oil on Sunday night, Oil costs gapped up more than $10 to begin the new week early morning in Asia exchanging, with Brent leaping to $137 while exchanging began, while WTI Crude opened at $128. The pair have withdrawn off their highs at the hour of composing, however the retracement isn't supposed to keep going extremely lengthy.

Horticultural item costs additionally flooded higher, with Wheat cost flooding past its 15-year high to $13.40 as Russia and Ukraine together orders around 30% of worldwide wheat

The cost of Wheat went "limit up" a few times, acquiring a record 25% in only one-week, driving the ware list to its greatest week by week hop in 60 years. The last time the product list bounced this much in seven days was in 1974.

Not to be surpassed by the rest, the place of refuge resource with the longest history, Gold, additionally rose 4.7% last week, while Silver made a comparative increase of around 4%. The two metals start the week looking bullish, with Gold playing with the $2,000 level, while Silver has crossed $26.

Fence gambles with valuable metals

Cryptographic forms of money then again, didn't had as straight forward seven days as different products, with these blockchain resources not ready to clutch their initial week gains. BTC drove the crypto market higher at first, bouncing around 15% to $44,000, yet couldn't stay aware of the potential gain force and ultimately finished the week offering back practically its benefits in general.

The Russian Bid Sent BTC Jumping 15% Early Week

With new influx of assents hitting Russian banks and the Ruble free-falling, Russians raced to change over their quick declining abundance into cryptographic forms of money, explicitly, BTC, toward the beginning of the week.

Information shows that exchanging volumes between the Russian Ruble and BTC expanded to a nine-month high as the country's government issued money plunged to record lows, with BTC exchanging volume flooding to almost 1.5 billion RUB on Thursday, hitting its most significant level since May.

With a mass migration of Rubles into BTC, the cost of BTC cited in Ruble terms flooded enormously, with the cost of BTC exchanging practically 40% higher in Russia than on abroad trades.

This request has driven the cost of BTC higher abroad in the long run, with BTC bouncing 15% on Tuesday in a speedy flood to $44,000, exchanging around $300 million worth of crypto shorts.

BTC Retreats While Gold Edges Higher

Nonetheless, after disclosures that the use of cryptographic forms of money wouldn't have the option to assist Russian clients with staying away from sanctions, the cost of digital currencies dropped back before the week's over.

The cost of BTC fell around 8% on Friday to a low of $38,600, while altcoins experienced more, losing a normal of 15%. With no regrettable news emerging from the area, the downfall is generally seen because of hazard off opinion overarching as financial exchanges internationally disintegrated.

Early week expects BTC value activity to decouple from that of the financial exchange have been run as the cost of BTC fell in lockstep with the US financial exchange again on Friday.

One more justification behind the drop in BTC cost could be the Russian interest melting away as different concentrated crypto trades have consented to endorse Russian clients.

With BTC value's direction reflecting that of the financial exchanges which have gone under weighty strain from the consequences of war, apparently Gold has turned into the better place of refuge resource right now.

Long-Term Holders Not Selling BTC Yet

Notwithstanding the frustrating cost activity from BTC amidst war, long haul BTC holders are holding on and not selling their valued resource.

A keep an eye on the development of BTC proposes that 61.72% of BTC which has been held for over 1-year have not moved. This level of hodling has been ascending since the start of 2022 and has gotten pace as the Russia-Ukraine war breaks out, showing the compelling conviction that BTC advocates have about their beloved abundance safeguarding resource right now. An expansion in the level of financial backers holding decreases the stock of BTC ready to move, which might protect the cost of BTC from falling further.

LUNA's Algometric Stablecoin Gains Popularity

Regardless of hopping a decent 15% last Tuesday to lead the crypto market higher last week, BTC was not the most ideal performing cryptographic money by a far edge. The enormous cap token that was the top entertainer was LUNA, the local badge of the Terra blockchain.

Staying aware of the speed of its ascent the prior week, LUNA rose 38% last week, ascending from $70 on Monday last week to top $97 prior to backtracking to $82 on Friday. Indeed, even after this pullback, the token has multiplied from its low of $47 scarcely fourteen days prior.

What is driving this phenomenal outperformance when the remainder of the crypto market has been faltering?

Throughout the course of recent days, LUNA's TVL has expanded 26.9% and sits well above third-set BNB Smart Chain (BSC) at $12.03 billion worth of TVL. The expansion in TVL on LUNA could be because of an expansion popular of its algorithmic stablecoin UST. Clients need to secure their LUNA token n request to print more UST. As the utility for decentralized cash acquires spotlight because of the weaponization of government issued money by different legislatures as of late, the decentralized idea of the UST has made it extremely famous, with interest for the stablecoin expanding by over 14.5% to 12.92 million tokens in February alone (even before the Russian conflict). This implies that a super relating measure of LUNA tokens have been locked unavailable for general use a month ago. With the new endorses on Russia last week, interest for UST could raise further since its creation and utilization is through Decentralized Finance which is unknown and oversight safe.

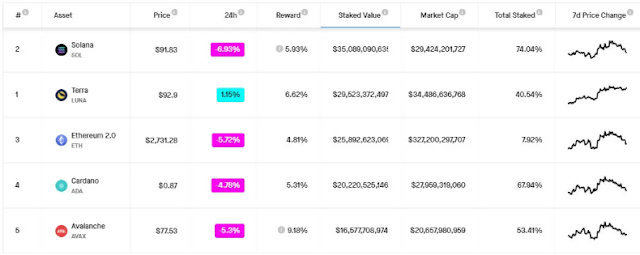

The absolute marked worth of the LUNA token has likewise surpassed that of ETH last week, with LUNA flipping ETH to second place as the blockchain with the most noteworthy esteemed marked. SOL stays as the blockchain with the most noteworthy measure of marking.

While the underlying impetus that began LUNA's gravity resisting rally was the consuming of 29 million LUNA tokens by the Terra convention in late February, which discounted its circling supply by around 2%, the rising interest for the UST token on the rear of international strains could keep on pressing the cost of LUNA higher.

Strangely, the LUNA Foundation reported over the course of the end of the week that it would change over 5 million LUNA tokens from its depository to UST to satisfy overpowering need for the stablecoin. While how much LUNA changed over is anything but an enormous level of its stockpile, this occurrence further demonstrates that the algorithmic stablecoin on the Terra blockchain is at present encountering a colossal interest, which is useful to the cost of LUNA.

Comments

Post a Comment

Lets Talk Business